File IRS Tax 2290 Online

Quickly & Securely

- 100% acceptance or Money Back

- VIN Correction for Free

Pricing Starts at $14.90

Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

IRS Tax 2290 - An Overview

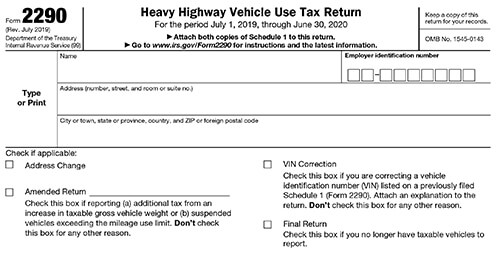

Tax 2290 form is a federal excise tax filed by the owners of the taxable heavy vehicles who are using the public highway for transportation. You need to file the IRS Form 2290 during the fiscal year of July 1st to June 30th.

Truckers whose vehicle’s taxable gross weight is 55,000 pounds or more should e-file the IRS Form 2290 for getting the stamped copy of the Schedule 1. Frankly, this is applicable to any taxable highway motor vehicle that is registered under your name under the state, District of Columbia, Mexican or Canadian law during its use in a given tax period.

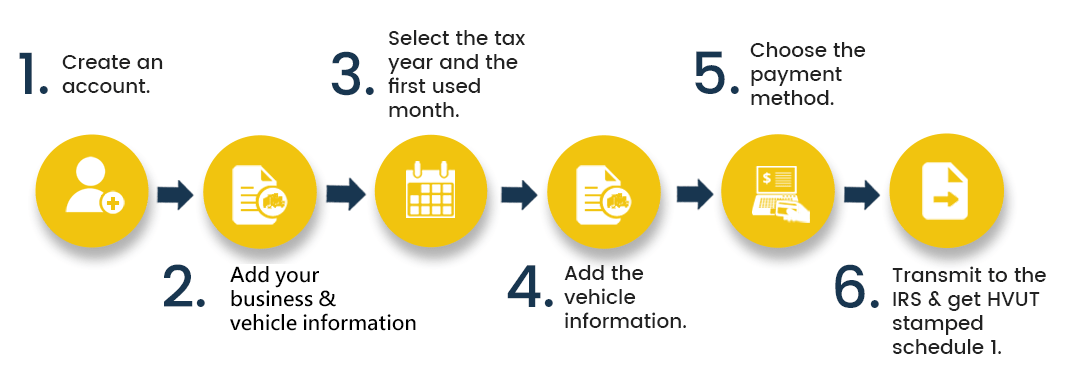

To file Tax 2290 form, you need details like the EIN, name of the business, address, and details of the authorized signatory. In addition, you need the details of the VIN, vehicle and its gross taxable weight.

Advantages of Filing IRS Tax 2290 with Us

Receive Stamped Schedule 1 in minutes

Once the IRS Form 2290 is approved, you will get the official stamped Schedule 1 in minutes.

Free VIN Corrections

If you accidentally entered the wrong VIN while e-filing, you can rectify it by e-filing a Free VIN correction.

Multi-User Access

Irrespective of whether you are working with several employees or accountant, you can provide access to multiple users for accessing your Tax 2290 forms.

Bulk Upload

Don’t fret if you have various trucks to file for. You can easily save time by e-filing with our bulk upload feature.

100% US-Based Customer Support

We provide 100%, US-based customer support which is available from Monday to Friday, 9 AM to 6 PM EST along with 24/7 email support.

IRS Authorized

We are one of the best and recognized IRS authorized e-file providers. We will ensure that when you e-file your IRS Form 2290, your return is transmitted securely and safely.

Benefits of E-Filing IRS Tax 2290 over Paper Filing

- Doubts and queries answered by a Live support team.

- File your Tax 2290 form online and get your Stamped Schedule 1 within minutes.

- No need to go to the IRS office and wait in the long line for filing.

- E-filing for Form 2290 amendments.

- Stamped Schedule 1 sent in a matter of minutes.

- Fast and easy e-filing process which cost less than $10.

- Schedule 1 send by fax, text or email.

- Free instant tax audit.

Click Here to Know more benefits of E-Filing Form 2290.

Requirements to File IRS Tax 2290 Electronically

- Name and Address of the Business.

- Employee Identification Number (EIN).

- First Use Month (FUM), Vehicle Identification Number (VIN) and Taxable Gross Weight of the Vehicle.

- Suspended Vehicle If any.

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-instructions/ to find more 2290 filing Instructions.

About itax2290.com

We, itax2290.com are one of the best and customer friendly truck tax solution providers who always ensure that you have a smooth e-filing of your Tax 2290 form. Our aim is to make the process of filing IRS Form 2290 easy, quick and efficient, making sure that you concentrate on other aspects of your business. We provide all solutions to all of your form 2290 e-filing and extra offers live phone and chat support.